Weekly ChartS...

As a subscriber to the Weekly ChartStorm I have to assume you like charts, and I also have to assume that you have a level of interest in macro and markets...

So I wanted to invite you to subscribe to my other [FREE] publication — the Chart Of The Week.

Each week you get one of the most important macro/market charts on my radar, handcrafted by yours truly :-) Aside from the chart I also explain in detail what it is, what it’s telling us, and why it matters for investors. Subscribe now (select the free option for the Chart Of The Week).

Here’s a selection of recent charts of the week, for your reference:

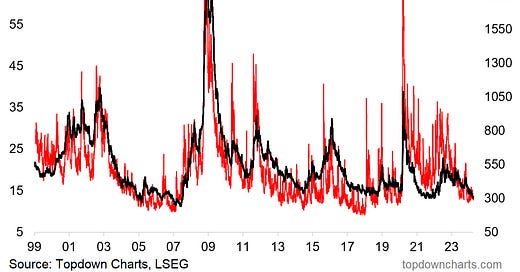

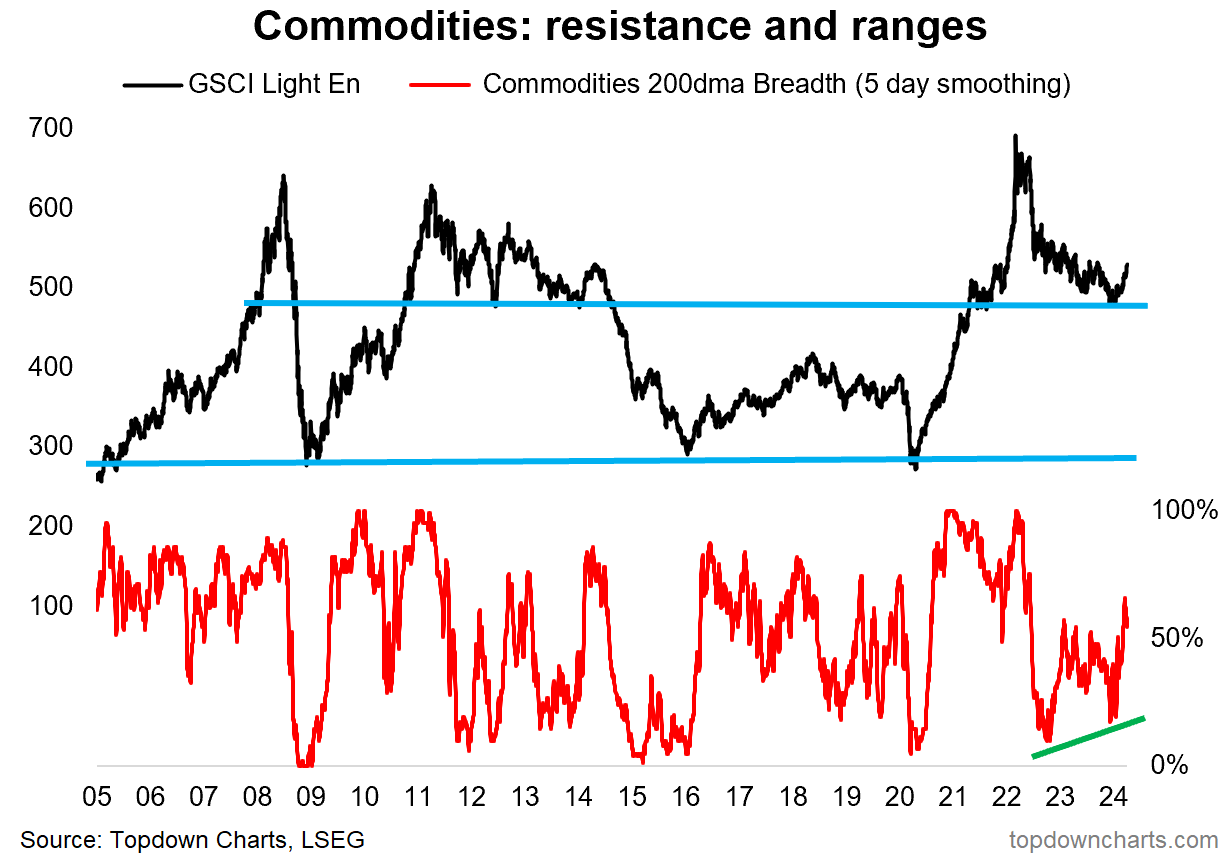

Credit Spreads and Volatility: nearly every indicator of risk pricing, be it credit spreads, equity volatility, emerging market risk sentiment — investors have been lulled into a sense of calm and complacency. Bullish sentiment, peak policy rates, and easier financial conditions are a key driver and in some respects it can become a virtuous cycle. But with significant (geo)political risks, lingering upside risk to inflation, and expensive valuations, I think this may fall into the “a little too calm” category.

Link to Source: Chart of the Week - The Calm

Global Equities Relative Value: this chart tracks the relative value of small caps vs large caps, value vs growth, and global vs US stocks. Thanks to years of underperformance by small/value/global (and stunning outperformance by US/large/growth) a rare relative value trinity has opened up. Very important chart for longer-term-minded value-driven investors.

Link to Source: Chart of the Week - Where's the Value?

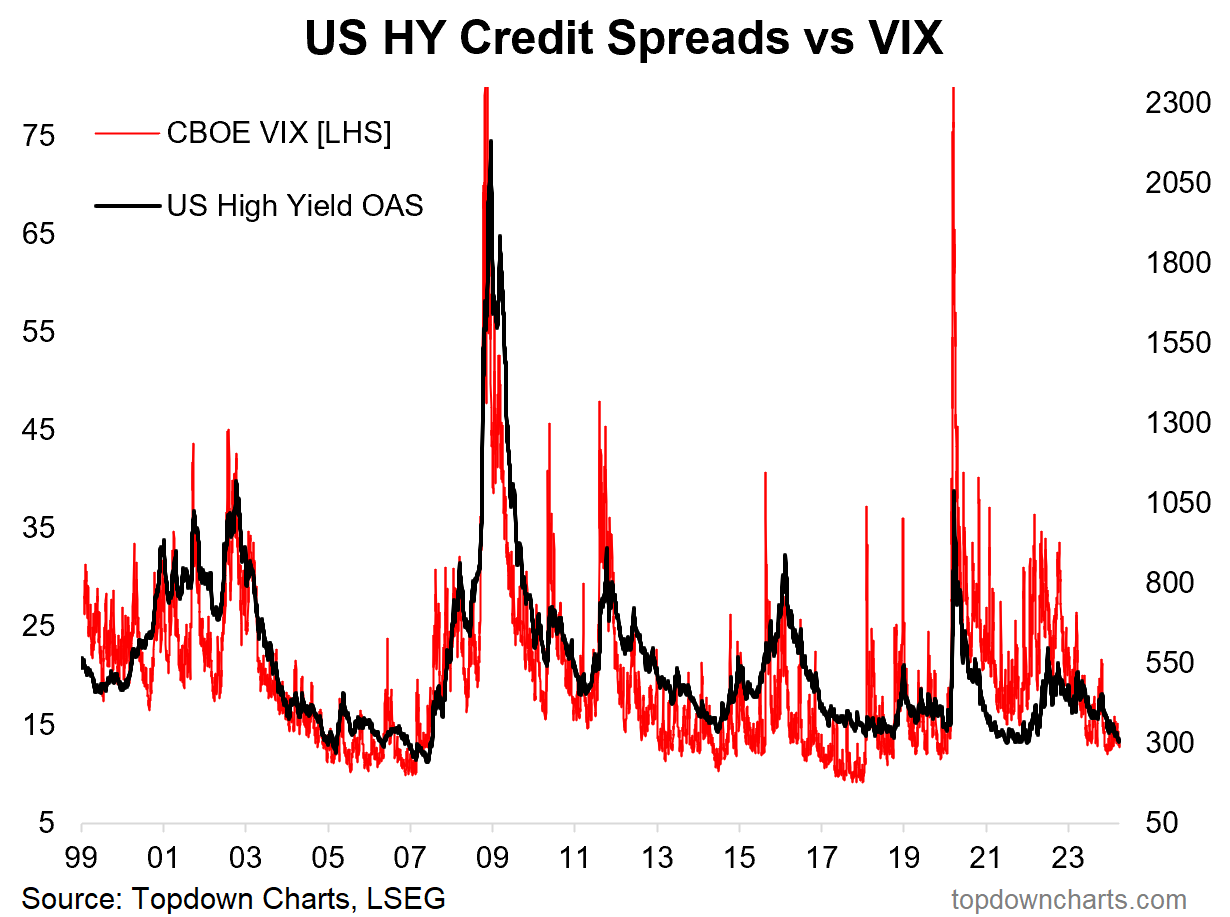

Bullish Commodities: on just about every indicator and angle I look at, I see significant upside risk for commodities. While there is more to the story, this chart shows the bullish technicals picture (the index successfully testing support, bullish breadth divergence, and the breadth indicator turning up from oversold. Add to that almost a decade of underinvestment and the story becomes quite compelling here.

Link to Source: Chart of the Week - Bullish Commodities

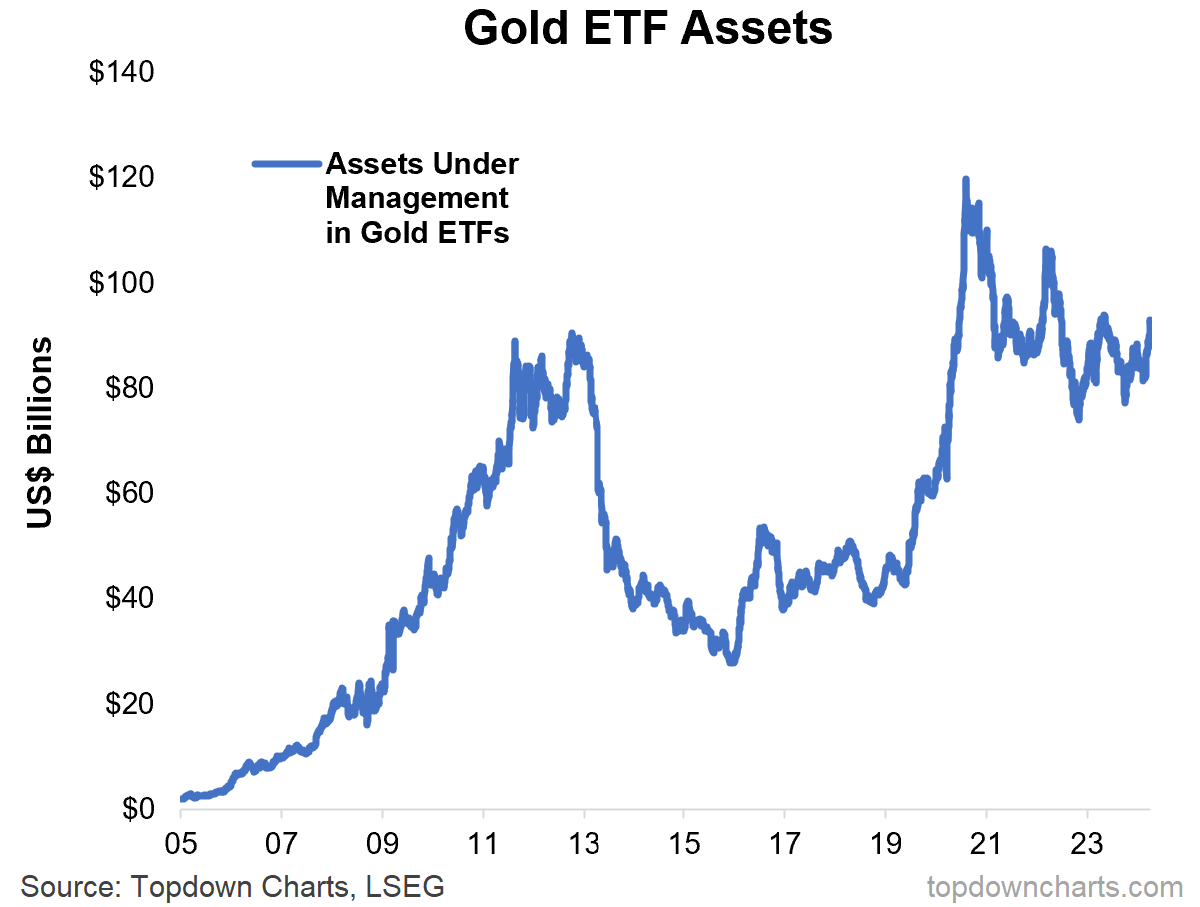

Retail Skepticism: it seems almost every passing day we get a new high in the gold price. Increasing geopolitical risk, debt monetization concerns, global central bank buying of gold (which ties back to geopolitics and sanctions risk), inflation resurgence risk, and a general uplift in liquidity… all bullish supports for gold. But as things stand, retail remains skeptical, uninterested, distracted(?) on gold — assets in gold ETFs remain well below the all-time highs. Key chart to monitor: when/if retail starts to chase this it could fuel a further wave up in gold.

Link to Source: Chart of the Week - Gold ETF Assets

Global Growth Reacceleration: move over recession risk, a new macro risk has dropped — growth reacceleration risk. And it seems to be becoming more a reality than a risk as the global manufacturing PMIs turn up and several other cycle indicators begin to reaccelerate. The next step would be inflation resurgence as growth reacceleration likely boosts commodity prices and will come in the context of still tight capacity (especially in the labor market). This, if true, will be good for cyclical, value, global stocks, and likely be bad for bonds and growth stocks and mean a postponement of rate cuts for the Fed and others.

Link to Source: Chart of the Week - Reacceleration Risk

Subscribe to the free Chart Of The Week series

NOTE: you might be prompted to subscribe to the paid service when clicking that link, but for the free Chart Of The Week just click the “None” (the Free option).

Also, n.b. for reference, that site: http://entrylevel.topdowncharts.com hosts the entry-level version of my institutional research offering at Topdown Charts. For more info see “what is the Weekly Insights report?” (that service is aimed at asset allocators, financial advisors, fund managers, professional investors who require actionable top-down asset allocation research)

Thanks for reading, hope to see you also on the Chart Of The Week list! :-)

Thanks and best regards,

Callum Thomas

Founder & Editor of The Weekly ChartStorm

Twitter: https://twitter.com/Callum_Thomas

LinkedIn: https://www.linkedin.com/in/callum-thomas-4990063/